Daily Comment – Tensions remain high in equities

- Strong US data is not welcomed by equities

- Busy calendar today but markets are already focusing on next week

- Japan holds election on Sunday; the outcome could surprise

- BoJ and yen could suffer from a hung parliament

Data reconfirm the strength of the US economy

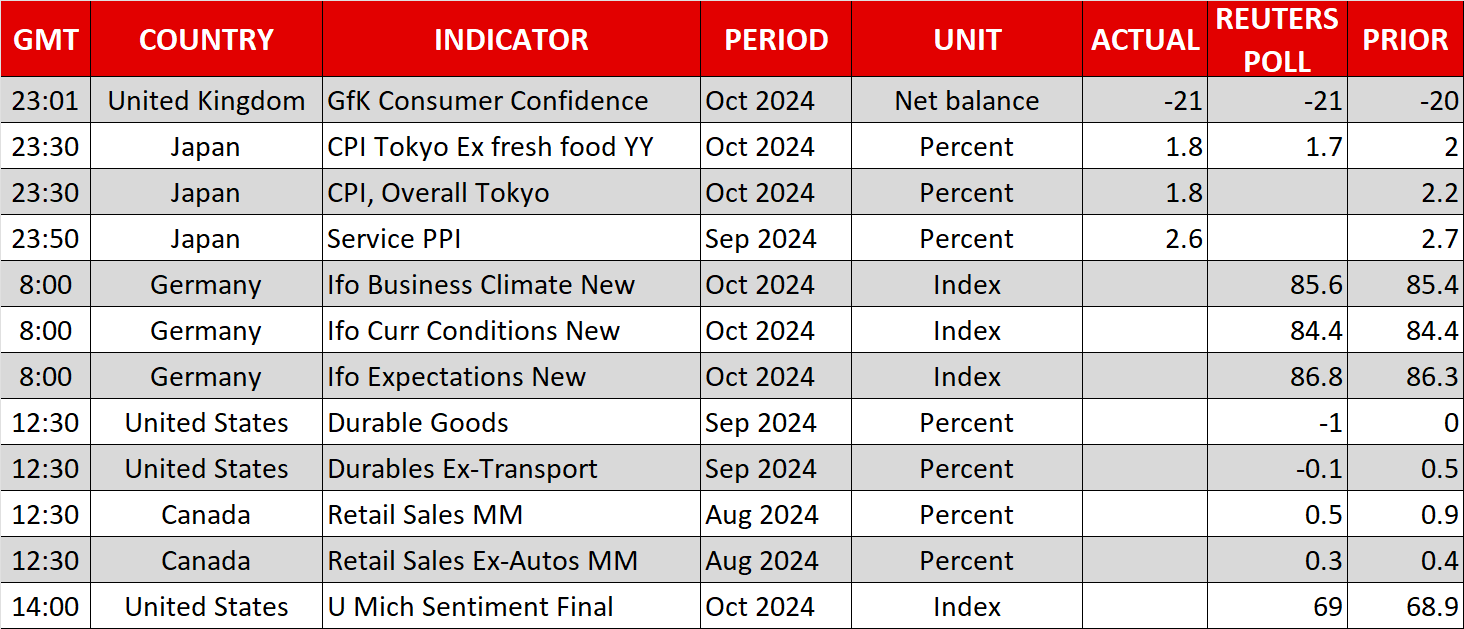

Yesterday’s PMI surveys release was a stark reminder that the US presidential election is not the sole market-moving factor. The next Fed meeting will be held two days after the election date and, assuming an eventless election process occurs, Chairman Powell et al will evaluate the progress made since the September aggressive rate cut.

The message from yesterday’s preliminary PMI surveys, the jobless claims figures and the new home sales data was that the US economy is still growing at a respectable rate, far above the growth achieved by most developed countries. The Fed hawks are not 100% on board for another rate cut, but the market will have to wait for November 7 for further comments on monetary policy, as Fedspeak will gradually diminish due to the usual blackout period that occurs before FOMC meetings, commencing shortly. The market, though, remains confident that a 25bps rate cut will be announced in a fortnight.

The message from yesterday’s preliminary PMI surveys was that the US economy is still growing at a respectable rate

Today’s durable goods report could prove the main event of the session, ahead of next week’s very busy calendar. The combination of the October jobs report and the first release of the third quarter GDP has the potential to further increase divisions in the Fed ranks and dent the US dollar’s recent strength.

Data releases confuse equity investors

In the meantime, US equity indices are caught up in the middle. Investors are trying to navigate through this pre-election period, as the rhetoric is gradually becoming more aggressive, US economic data is producing further surprises, and third quarter earnings are picking up speed.

US indices remain in the red this week, with the Dow Jones index suffering from yesterday’s weak earnings result from IBM. The Nasdaq 100 index is doing slightly better but that might change dramatically if next week’s barrage of earnings from Alphabet, Microsoft, Meta and Amazon fail to appease investors.

The Nasdaq 100 index is doing slightly better but that might change dramatically if next week’s barrage of earnings fail to appease investors.

Japanese elections on October 27

Following a weak set of inflation figures from Tokyo, which are usually a very strong predictor of national CPI, the market is preparing for Sunday’s general election in Japan. The LDP party is expected to earn the highest number of votes, but the latest polls increase the possibility of the LDP failing to achieve the necessary majority in the lower house, even with the help of its junior partner. In that case, the leading party would have to look elsewhere for the necessary support to form a new coalition, making generous compromises.

In the meantime, the yen remains under pressure, having quickly lost almost 60% of its July-September outperformance against the dollar. The BoJ is meeting next week, but the market has turned its focus to the December gathering. Political uncertainty along with weaker data prints could potentially force Governor Ueda et al to postpone any December decisions and thus remove the strongest tailwind for the yen.

Political uncertainty along with weaker data prints could potentially force Governor Ueda et al to postpone any December decisions

免责声明: XM Group仅提供在线交易平台的执行服务和访问权限,并允许个人查看和/或使用网站或网站所提供的内容,但无意进行任何更改或扩展,也不会更改或扩展其服务和访问权限。所有访问和使用权限,将受下列条款与条例约束:(i) 条款与条例;(ii) 风险提示;以及(iii) 完整免责声明。请注意,网站所提供的所有讯息,仅限一般资讯用途。此外,XM所有在线交易平台的内容并不构成,也不能被用于任何未经授权的金融市场交易邀约和/或邀请。金融市场交易对于您的投资资本含有重大风险。

所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。

本网站上由XM和第三方供应商所提供的所有内容,包括意见、新闻、研究、分析、价格、其他资讯和第三方网站链接,皆保持不变,并作为一般市场评论所提供,而非投资性建议。所有在线交易平台所发布的资料,仅适用于教育/资讯类用途,不包含也不应被视为适用于金融、投资税或交易相关咨询和建议,或是交易价格纪录,或是任何金融商品或非应邀途径的金融相关优惠的交易邀约或邀请。请确保您已阅读并完全理解,XM非独立投资研究提示和风险提示相关资讯,更多详情请点击 这里。